2016 IT and Comms predictions by Martin Hingley

Open Research

By Martin Hingley

Do you have a question about this research

2016 IT and Comms predictions It’s that time of the year again.. time to look at the new year and make a few predictions. My forecasts cover those areas and themes that look most likely to prosper. As in 2015 the dramatic changes in exchange rates will make the market difficult. Market growth will continue to be affected by sovereign debt, austerity budgets and lower oil prices

To find out more about any of the below predictions email dblatch@nylitik.com

-

The world ITC market declines by 1.2% to $5.8 trillion

-

EMEA and the Americas outgrow Asia Pacific – at least in constant dollars

-

The USA grows faster than other American countries

-

Turkey top, Russia bottom of EMEA growth (again!)

-

Chinese spending declines in the lacklustre Asia Pacific market

-

Raw storage and services drive Big Data growth

-

Cloud Computing continues to surge – SaaS is the star

-

Applications dominate in the shift towards a ‘Software Defined’ future

-

Small businesses spend more, consumers less in 2016

-

Manufacturing and ‘Other’ lead among vertical markets

1. The world ITC market declines by 1.2% to $5.8 trillion

In 2015 the market declined by 5.1%, so its unlikely to see a recovery in the year. My forecast is for a 1.2% decline, with the market reaching $5.8T. Performance by category will vary. In particular:

-

Software will grow 4.2% to $916B: although it lags in revenues, it will continue to delivery the highest profitability of all 4 categories

-

IT service will grow by 0.6% to $1.6T; the fastest growing segments will be IaaS and PaaS, although they will be only a fraction of the total revenue

-

Hardware will remain level at $1.2T; the decline in PCs and printers will be steeper than smart phones and tablets; wearables and 3D printers will grow fastest

-

Telecom service will decline by 1.3% to $2.1T; successful vendors will improve their efficiency and profitability by investing in virtualisation

-

All-in-all it’s not going to be a great year: the lack of growth will drive even more merger and acquisition activity than in 2015.

2. EMEA and the Americas outgrow Asia Pacific

The slackness of the market will also be apparent in region spending growth. In particular:

-

The Americas will outperform the others, growing by 0.5% to $2.3T; vendors will need to offer innovative products to persuade these sophisticate users to buy yet more technology

-

EMEA will grow by 0.3% to $1.7T; wildly varying exchange rates will make it difficult to assess which countries vendors should target

-

The market in Asia Pacific will decline by 4.6% to $1.8T; while there are many opportunities to expand in the smaller countries, the largest ones will disappoint many

In the following predictions I’ll take a look at the countries within each of these regions in turn.

3. The USA grows faster than other America countries

The USA is by far the largest country market worldwide and within the Americas: in 2016 it will spend $1.7T – 28% of the world total. Growth will be 1.2% – better than other countries in the region. We need the US to grow in order to make up for the fall in spending in ‘growth’ markets, which will continue to be badly affected by the fall in oil prices.

4. Turkey top, Russia bottom of EMEA growth (again!)

EMEA is a region full of country markets. Germany is the largest, followed by the UK. For the second year running I expect the strongest growth (3.8%) to be in Turkey and the steepest decline (-10.7%) to be in Russia. The lifting of sanctions on Iran will lead to growth (2.3%).

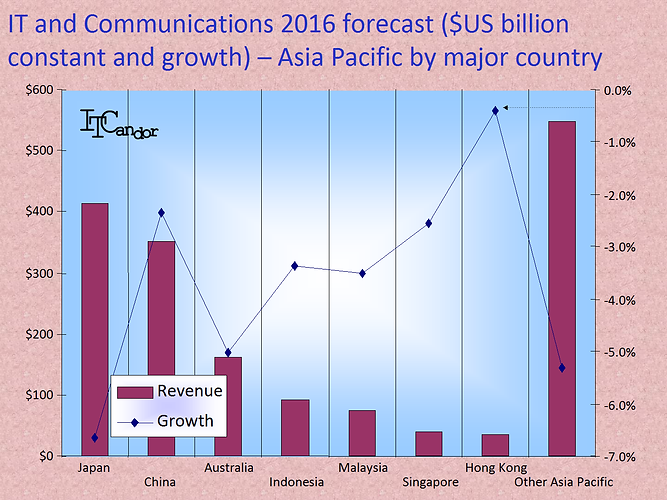

5. Chinese spending declines in the lacklustre Asia Pacific market

Japan and China will be the two largest IT and communications markets in Asia Pacific. For the first time in a number of years I’m not predicting that the region will outgrow the Americas and EMEA: in fact I expect we’ll see a decline in spending in most countries. Even in China spending will decline by 2.4% to $351B.

6. Raw storage and services drive Big Data growth

Over the last few years there’s been shift in spending away from storage arrays and towards raw storage. I expect this to continue in 2016. In total the market will grow by 2% to $115B, with the strongest growth in raw storage (+4.2%) and associated services (_4.4%). These moves are likely to accelerated by the merger of EMC and Dell later in the year. Although small, analytics software will also grow (+1.2%).

7. Cloud Computing continues to surge – SaaS is the star

Cloud computing will grow by 13% to reach $354B. The strongest growth will be in SaaS (26.3%), which we count as part of the software market. IT services engage to build and manage private, public and hybrid clouds will grow by 16.3%, PaaS by 7.7% and IaaS by 8.1%. The shift towards cloud computing can be seen as the development of computing as a utility. Fewer companies will build and run their own datacenters, preferring to rely on service providers to provide applications.

8. Applications dominate in the shift towards a ‘Software Defined’ future

Cloud computing will grow by 13% to reach $354B. The strongest growth will be in SaaS (26.3%), which we count as part of the software market. IT services engage to build and manage private, public and hybrid clouds will grow by 16.3%, PaaS by 7.7% and IaaS by 8.1%. The shift towards cloud computing can be seen as the development of computing as a utility. Fewer companies will build and run their own datacenters, preferring to rely on service providers to provide applications.

9. Small businesses spend more, consumers less in 2016

2016 I expect consumer spending to decline by 3.2% worldwide to reach $2.2T. Of the business sectors spending by small companies (those with 100 or fewer employees) will grow by 2.2%, while investment by medium businesses (those with between 100 and 1,000 employees) will decline by -0.2% and large ones (those with over 1,000 employees) by –2.2%. The decline in large company spending will be due in part by the continued adoption of cloud computing and other cheaper solutions than used hitherto.

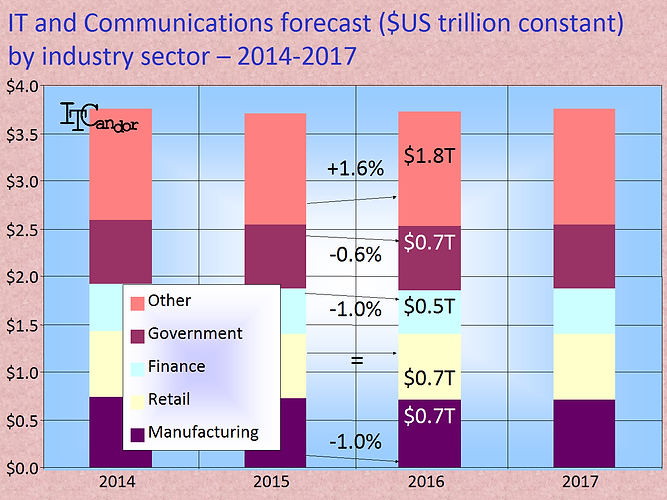

10. Manufacturing to lead among vertical markets

Total spending by businesses in 2016 will be $3.7B. I expect most of the traditional sectors to spend less than they did in 2015. Manufacturing and finance industries will spend 1.0% less, while government investments will drop by 0.6%. I expect retail spending to be the same ($0.7T) as 2015. The strongest growth will be in ‘other’ sectors, which includes Healthcare and Education.

As always I wish you well as you navigate the ITC market. Let me know if you need any help as you draw up your business plans.

By Martin Hingley

Originally Published by